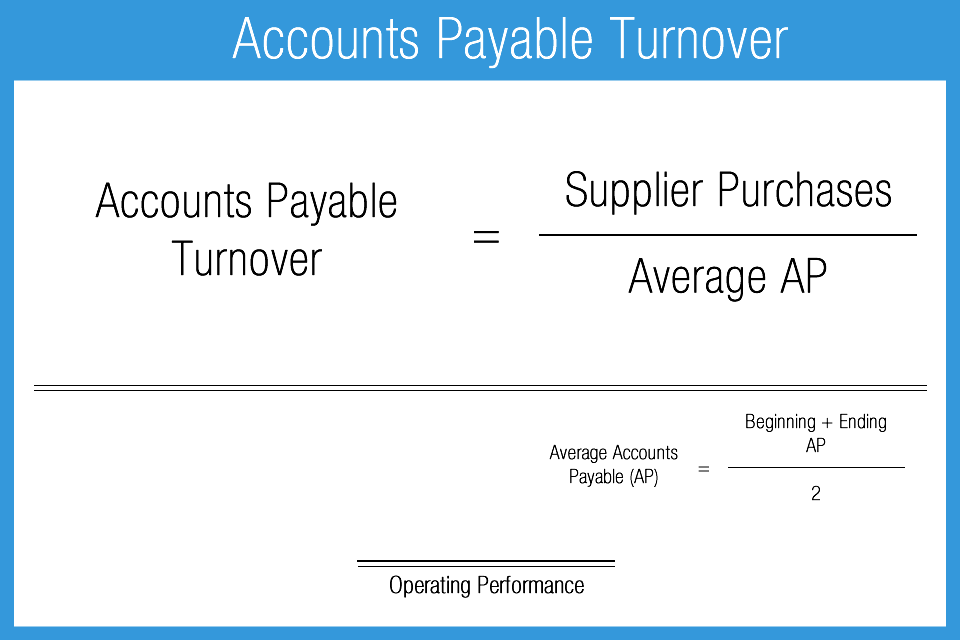

On the other hand, the lower the AP turnover ratio, the slower the company pays off such debts. For example, the higher the accounts payable turnover ratio, the faster the organization pays off its debts to suppliers that extend business credit lines. Often management questions whether a higher accounts payable turnover is better as it shows the company’s ability to pay its short-term obligations. Is higher accounts payable turnover better? The formula for calculating the AP turnover ratio is Accounts Payable Turnover Ratio = Net Credit Purchases/Average Accounts Payable. The accounts payable turnover ratio is calculated by figuring out the average number of times a company pays its AP balances during a specific time. As a result, the AP turnover ratio is a key indicator of creditworthiness based on an organization’s payment history. The accounts payable turnover ratio is the time it takes a company to make payments to its suppliers that extend lines of credit.

So, what is the accounts payable turnover ratio? Find out more about the accounts payable turnover ratio and what it means to the overall profitability. Often these decisions are based on the current market. Some companies take longer to pay to use the cash flow for investments, while others take advantage of discounts for early payments to suppliers. After all, making timely payments to suppliers ensures continued production and builds a strong brand reputation.įactors such as cash flow and accounts payable best practices influence the time it takes to pay invoices. Defining the AP turnover ratio also helps determine the creditworthiness of a business.

:max_bytes(150000):strip_icc()/Accountspayableturnoverratio_final-d17fff78f8f24fc9bb4b1fd8697d41f7.png)

As a result, it is crucial to know how long it takes to pay invoices and why. Understanding the accounts payable turnover ratio for an organization reveals its financial health.

0 kommentar(er)

0 kommentar(er)